Both January and February of this year have started stronger than the same two months in 2023. Year-to- date, 9,817 residential resale properties have been reported sold by the Toronto Regional Real Estate Board. Although this number is no where near the sales numbers buyers and sellers became accustomed to during the pandemic, and before the Bank of Canada began increasing its benchmark rate, it is 25 percent higher than the 7,857 properties sold over the same period last year. At first blush this may seem odd, given that in January and February of 2023 the Bank of Canada’s benchmark rate was 4.25, 0.75 basis points lower than the current rate of 5.0 percent. How does one explain this apparent contradiction?

During the early months of 2023, the Bank of Canada was very hawkish, making it clear that it would bring down inflation at all costs and regardless of the negative impact on the residential resale market. Buyers and sellers, if not terrified, were certainly apprehensive. The Bank of Canada was not only raising its benchmark rate but there was no end in sight. These two periods, a year apart, dramatically demonstrated the impact buyer and seller psychology can have on the market.

Two facts have changed in the early months of 2024, notwithstanding that the Bank rate is higher than last year. Firstly, the Bank of Canada is no longer hawkish. Even though it did not lower its overnight rate at its meeting in early March, it made it clear that rates are not going to rise, and in fact will decline in 2024. What it did not indicate was when. Secondly, the Bank’s “positive” statements have no doubt convinced the consumer that we are at a point where market opportunities may be nearing an end, so if you are a buyer, and you can afford current average sale prices, now is the time to get into the market. The prevailing view is that when the Bank rate begins to decline, sale prices for properties in the Toronto Region will begin to increase, making the cost of housing more unaffordable than it currently is.

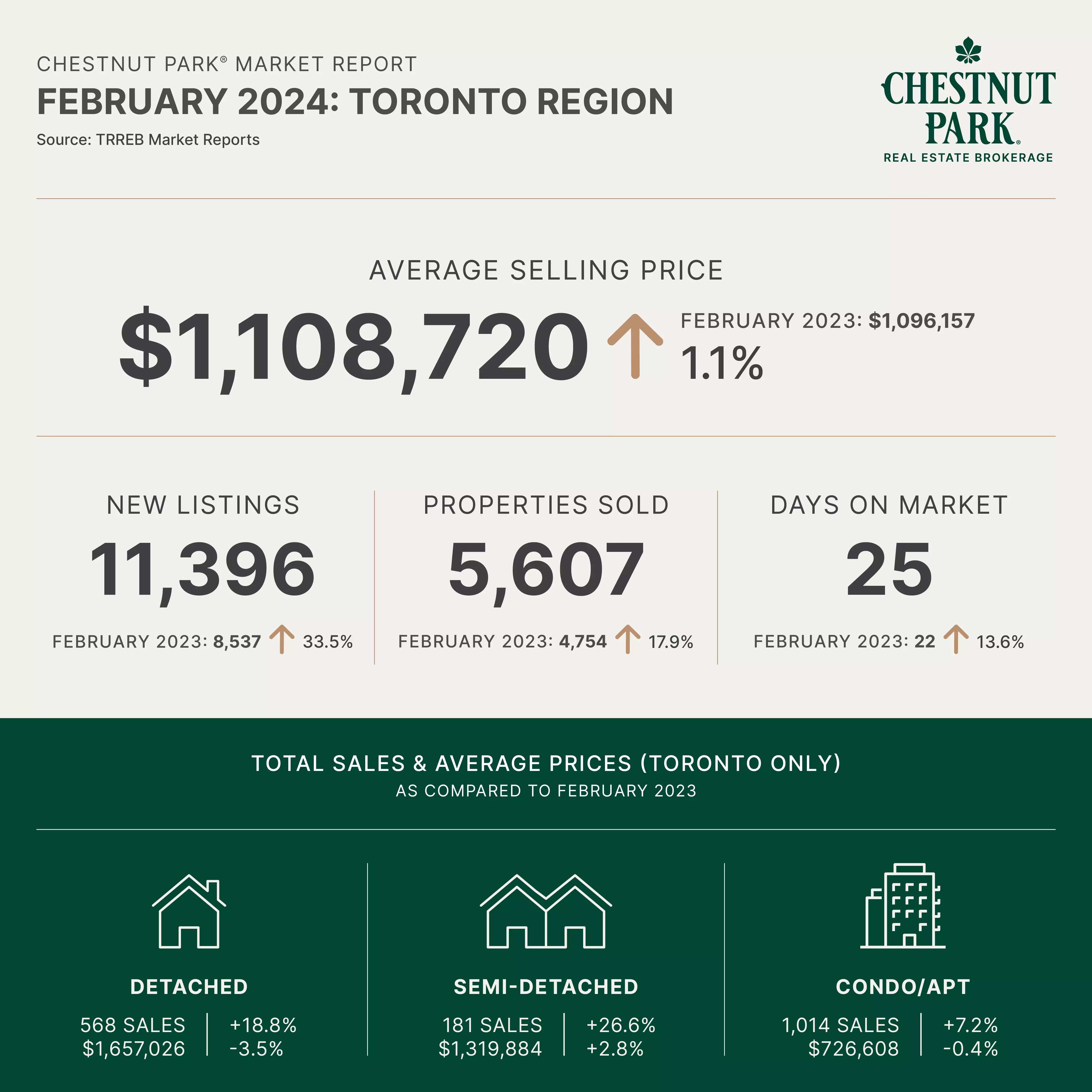

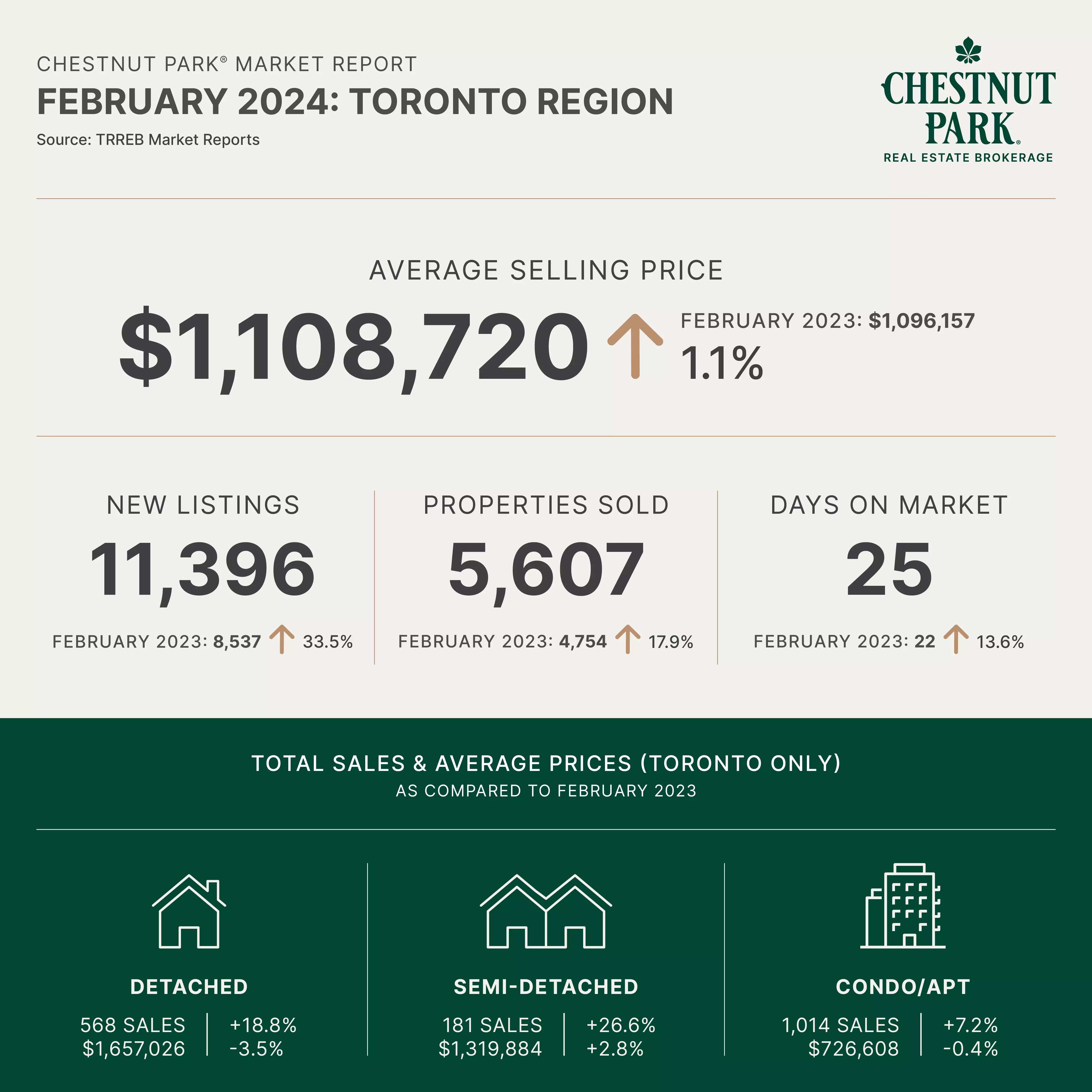

As a result of this prevailing thinking, February’s resale data was substantially stronger than February 2023. This February, 5,607 homes were reported sold, almost 18 percent more than the 4,754 sold last year. Not only did more residential properties sell, but they sold for higher prices than last February. The average sale price for all properties sold in February came in at $1,108,720. Last year, it was $1,096,157, 1.1 percent less.

A deeper dive into the resale data indicates that the market is not performing uniformly. Affordability, or lack thereof, is the market’s driving force. In the City of Toronto, the average sale price for detached properties declined by 3.5 percent, from $1,712,364 last year to $1,657,026 this February, even though the number of properties sold increased by an eye-popping 18.8 percent. Similarly, though less dramatically, condominium apartment average sale prices declined, from $728,271 last year to $726,608 this year, but a decline, nonetheless. The price decline happened, surprisingly, while condominium apartment sales in the City of Toronto increased by 7.2 percent. The condominium apartment market in the 905 region performed similarly, with price declines of 3.4 percent, while sales increased by 13.7 percent compared to February 2023. The only traditional housing type that increased in both average sale price and reported sales was semi-detached properties.

The reason for this market disconnect is affordability. The average sale price for all semi-detached properties sold in the City of Toronto came in at $1,319,884 (even less at $998,103 in the 905 region), a price point in-between the more expensive detached properties ($1,657,026) and the less pricey condominium apartments ($726,608). Given the prevailing mortgage interest rates – a little over 5 percent for 5-year fixed term mortgages, in addition to the mortgage stress testing, buyers at the higher and lower end of the market are having difficulty with the prevailing price – cost of money intersect.

There is no shortage of demand. This was made clear in February’s data. All properties sold, including all condominium apartments, in 25 days and at 101 percent of their asking price. If we isolate semi-detached properties, we see that they sold in only 20 days and at 105 percent of their asking price. As has become the norm in Toronto’s eastern trading districts, all semi-detached properties sold at 111 percent of their asking price and in only 18 days. Even with the prevailing affordability challenges that buyers face, these are extremely strong and robust numbers.

Going forward, the current market will continue to see the number of sales increase, while average sale prices remain constrained. Early data for March confirms this analysis. Early March numbers indicate that the Toronto and Region residential resale market is unfolding at a pace that is 39 percent faster than February, while the average sale price is coming in only marginally higher than it did at the same time the month before. The rising number of properties coming to market, which in February was 33.5 percent higher than last year, will provide fuel to the growing number of sales, which in turn will further alter the prevailing buyer-seller psychology.

During the early months of 2023, the Bank of Canada was very hawkish, making it clear that it would bring down inflation at all costs and regardless of the negative impact on the residential resale market. Buyers and sellers, if not terrified, were certainly apprehensive. The Bank of Canada was not only raising its benchmark rate but there was no end in sight. These two periods, a year apart, dramatically demonstrated the impact buyer and seller psychology can have on the market.

Two facts have changed in the early months of 2024, notwithstanding that the Bank rate is higher than last year. Firstly, the Bank of Canada is no longer hawkish. Even though it did not lower its overnight rate at its meeting in early March, it made it clear that rates are not going to rise, and in fact will decline in 2024. What it did not indicate was when. Secondly, the Bank’s “positive” statements have no doubt convinced the consumer that we are at a point where market opportunities may be nearing an end, so if you are a buyer, and you can afford current average sale prices, now is the time to get into the market. The prevailing view is that when the Bank rate begins to decline, sale prices for properties in the Toronto Region will begin to increase, making the cost of housing more unaffordable than it currently is.

As a result of this prevailing thinking, February’s resale data was substantially stronger than February 2023. This February, 5,607 homes were reported sold, almost 18 percent more than the 4,754 sold last year. Not only did more residential properties sell, but they sold for higher prices than last February. The average sale price for all properties sold in February came in at $1,108,720. Last year, it was $1,096,157, 1.1 percent less.

A deeper dive into the resale data indicates that the market is not performing uniformly. Affordability, or lack thereof, is the market’s driving force. In the City of Toronto, the average sale price for detached properties declined by 3.5 percent, from $1,712,364 last year to $1,657,026 this February, even though the number of properties sold increased by an eye-popping 18.8 percent. Similarly, though less dramatically, condominium apartment average sale prices declined, from $728,271 last year to $726,608 this year, but a decline, nonetheless. The price decline happened, surprisingly, while condominium apartment sales in the City of Toronto increased by 7.2 percent. The condominium apartment market in the 905 region performed similarly, with price declines of 3.4 percent, while sales increased by 13.7 percent compared to February 2023. The only traditional housing type that increased in both average sale price and reported sales was semi-detached properties.

The reason for this market disconnect is affordability. The average sale price for all semi-detached properties sold in the City of Toronto came in at $1,319,884 (even less at $998,103 in the 905 region), a price point in-between the more expensive detached properties ($1,657,026) and the less pricey condominium apartments ($726,608). Given the prevailing mortgage interest rates – a little over 5 percent for 5-year fixed term mortgages, in addition to the mortgage stress testing, buyers at the higher and lower end of the market are having difficulty with the prevailing price – cost of money intersect.

There is no shortage of demand. This was made clear in February’s data. All properties sold, including all condominium apartments, in 25 days and at 101 percent of their asking price. If we isolate semi-detached properties, we see that they sold in only 20 days and at 105 percent of their asking price. As has become the norm in Toronto’s eastern trading districts, all semi-detached properties sold at 111 percent of their asking price and in only 18 days. Even with the prevailing affordability challenges that buyers face, these are extremely strong and robust numbers.

Going forward, the current market will continue to see the number of sales increase, while average sale prices remain constrained. Early data for March confirms this analysis. Early March numbers indicate that the Toronto and Region residential resale market is unfolding at a pace that is 39 percent faster than February, while the average sale price is coming in only marginally higher than it did at the same time the month before. The rising number of properties coming to market, which in February was 33.5 percent higher than last year, will provide fuel to the growing number of sales, which in turn will further alter the prevailing buyer-seller psychology.

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !

Recent Posts

- NOVEMBER 2025: REAL ESTATE MARKET REPORT

- Holiday Hosting Space: What Move-Up Buyers Really Want in Entertaining Areas

- The Move-Up Buyer’s Year-End Checklist: Setting Up for 2026 Success

- OCTOBER 2025: REAL ESTATE MARKET REPORT

- Preparing Your Starter Home for Maximum Sale Value: A Move-Up Seller’s Guide

Categories

Archive